This map, taken from the County Planning Department’s GIS map, shows the various lodging businesses — mostly vacation rentals — scattered around Cambria that are registered with SLO County.

An audit of lodging businesses in SLO County territory came up with some pretty accurate results. And while some of those lucky enough to be audited owed taxes, overall it was on the mark.

According to a report by Keri Lekvold of County Auditor-Controller-Treasurer-Tax Collector James Hamilton’s Office, the County’s “transient occupancy tax” rate or TOT is 9-percent of the cost of a room night at all motels, hotels, vacation rentals, RV parks/campgrounds, and B&Bs. The exceptions are State Park Campgrounds, which refuse to collect local TOT.

The County also has a 2% tax on a room night that goes to its Business Improvement District or CBID. The CBID taxes are split 50:50 with the local town where they were collected. Each town has an advisory board appointed by County Supervisors that oversee the spending of its share of the money, mostly supporting special events, beautification projects and other uses that benefit the community overall and the lodging industry in particular.

The other half goes to the County CBID board and is used to promote only the unincorporated towns — Cayucos, Cambria, Templeton, Santa Margarita, San Miguel, Oceano, Nipomo and the areas in between.

A look at the County GIS Map, which tracks numerous demographic information sets, shows the location of every lodging business in the County areas. Zooming in on Cambria and Cayucos shows just how many vacation rentals are located in each and the distribution throughout the communities. (See: https://gis.slocounty.ca.gov/Html5Viewer/Index.html?configBase=https://gis.slocounty.ca.gov/Geocortex/Essentials/REST/sites/PL_LandUseView/viewers/PL_LandUseView/virtualdirectory/Resources/Config/Default and click on the “Layers” button at the bottom left corner to view the individual maps.)

There is also a 1.5% tax on a room night that goes to the Tourism Marketing District or TMD. That Countywide agency uses it to promote the County as a whole (city lodging businesses also pay into this).

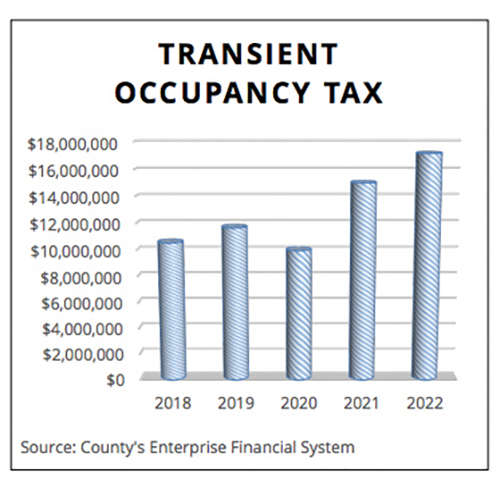

According to Lekvold’s report, County TOT in 2022 was $17.6 million. TMD taxes came to $2.93 million and the CBID’s take was $3.16 million.

So overall, the County is looking for lodging businesses to collect and remit 12.5% of a room rate ($12.50 for a room that cost $100). As one might expect, the taxes each would owe can vary widely by the type of lodging — i.e. major resort vs. little B&B; as well as by the actual costs for a room or campsite.

Still the audit, which covered from Jan. 1, 2019 through Dec. 31, 2022, according to Lekvold’s report, didn’t catch a lot of bad mistakes.

She told Estero Bay News that they regularly audit TOT receipts but had ramped it down during the COVID-19 pandemic.

“Of the six establishments audited,” Lekvold said, “three establishments were determined to owe a total of $5,931 in TOT, TMD, CBID, penalties, and interest to the County. One establishment overpaid $1,108 in TOT and TMD and was issued a refund.”

The rate of audited properties with problems or “discrepancies” — three of six — seems high at 50%, but Lekvold said it isn’t. “It should be noted that the high rate of audits with technical findings [50%] are not believed to correlate to revenues collected across the TOT program. Based on ACTTC’s audit experience, higher rates of technical (but small dollar) audit findings can be common with smaller operators, while larger operators generating most of the County’s TOT revenue are found to have a very low incidence of findings (the 20 largest establishments produce over 80% of TOT revenue).”

The six properties that were audited for this report were not named, which Lekvold said was the law.

“For reasons of business confidentiality,” she told EBN, “we’re careful not to provide evidence in public reports that could lead to particular businesses being identified.”

Knowing how much taxes a particular property collects, could be extrapolated out to reach an educated guess on the annual gross revenues from that place, which business people would tend to want kept on the QT.

According to a summary with Lekvold’s report the biggest of the audited properties had gross revenues of over $7.8 million and the audit shoed zero discrepancies, so they accounted for every penny of revenues.

The next largest reported $4.34 million in revenues but the County counted $4.75 million, a difference of $26,400 in gross receipts, about 0.6% off. That equated to $4,900 short in overall TOT paid. Another property was off by $775 in its revenue reports (gross of over $495,000) and owed $117 in TOT.

Another property that only reported $6,600 in revenues actually had over $13,600 and owed the County over $870.

And the property that paid too much, had reported gross revenues of $164,000 but the audit pegged it at $154,300 a difference of $10,500. That property is the one that got a $1,100 rebate.

Can properties that have a large discrepancy be subject to extra scrutiny in the future? “Correct,” Lekvold said, “the ordinance indicates that the County has the right to inspect the records at all reasonable times.”

The County’s ordinance mostly treats these matters as a civil issue and not necessarily a criminal one. However, Lekvold said the County law gives them that option.

“Yes,” she said, “there are potential criminal penalties. [Please see Ch. 3.08.140 Violations- Misdemeanor at http://slocounty-ca.elaws.us/code/cc_title3_ch3.08_sec3.08.140.] Historically, though, we’re unaware of any instances in our County of criminal charges due to underreporting TOT.

“Thankfully, we have always been able to resolve any issues directly with the business through our normal processes.”